2021 electric car tax credit irs

For vehicles acquired after 12312009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity 417 plus an additional 417 for each kilowatt hour of. 2019 was the last year to claim the full 30 credit.

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

In 2018 the IRS condensed Form 1040 significantly.

. As of January 2021 we are now in the first slab of the tax credit step down with a 4 reduction from 30 to 26. When claiming an electric car tax credit with Form 8834 youll need to make sure the vehicle meets certain requirements. Are there federal tax credits for new all-electric and plug-in hybrid vehiclesThis link will provide you an update by car manufacturer.

Avoid IRS delays in processing your 2021 tax filing it is extremely important to provide the exact dollar amount you received for EIP3. However there are a number of federal state electric car tax credits and other incentives that can lower the upfront cost so EV drivers can take advantage of fuel savings and reduced. These improvements could include a new roof new furniture or purchasing energy-efficient appliances.

The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs from entering the US market. The big difference in 2021 is that half of the child tax credit will be paid out via monthly payments of up to 300 per child through the end of the year. As part of the American Rescue Plan last year the Biden administration authorized a significant expansion of the child tax credit for 2021.

Previously this federal tax credit expired on December 31 2017 but is now extended through December 31 2021. Such equipment may include your work computer and the car you use to move between your properties. Overall the federal tax credit programs availability varies by automaker depending on the total number of electric vehicles a manufacturer has sold.

When you dig into your tax return for reporting 2020 income youll notice that Form 1040 has changed yet again. The tax credit now expires on December 31 2021. Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500.

The improvement must last for more than a year offer value to your rental. Any improvements to add value or extend the lifespan of your property may also be included. Although the State of New Jersey does not tax Unemployment Insurance Benefits UNEMPLOYMENT is subject to federal.

Last updated 8252021 On average the cost of an electric vehicle whether all-electric AEV or plug-in hybrid PHEV is higher than that of a conventional gas powered car. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. The Taxpayer Certainty and Disaster Tax Relief Act of 2020 extended the credit for qualified two-wheeled but not three-wheeled plug-in electric vehicles acquired between 2015 and the end of 2021.

Credit for Buying a Hybrid. As of August 2021 the US Senate through a non-binding solution has approved a 40000 threshold on the price of electric cars that would be eligible for a 7500 federal tax credit. Tax Season 2021 has begun.

Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. The Internal Revenue Service IRS has announced the annual inflation adjustments for the tax year 2021 including tax rate schedules tax tables and cost-of-living adjustments. As of 112021 the credit has dropped down to 26.

In most cases EIP3 was Single 1400 or Married 2800 plus each dependent 1400 Federal State Unemployment Benefits. Heres the full solar Investment Tax Credit step down schedule. Notice 2009-89 New Qualified Plug-in Electric Drive Motor Vehicle Credit.

Tesla on the other hand does not utilize unionized workers. The child tax credit typically works by lowering the amount of federal income tax parents owe which parents could either claim on their W-4 or at the end of the year on their tax return. All of the following criteria must be met in order to qualify for an electric car tax credit on any two- or four-wheeled.

Beyond that point all electric vehicles. Solar Tax Credit Step Down Schedule. The expansion also directed the IRS to send out half the credit to qualifying parents and.

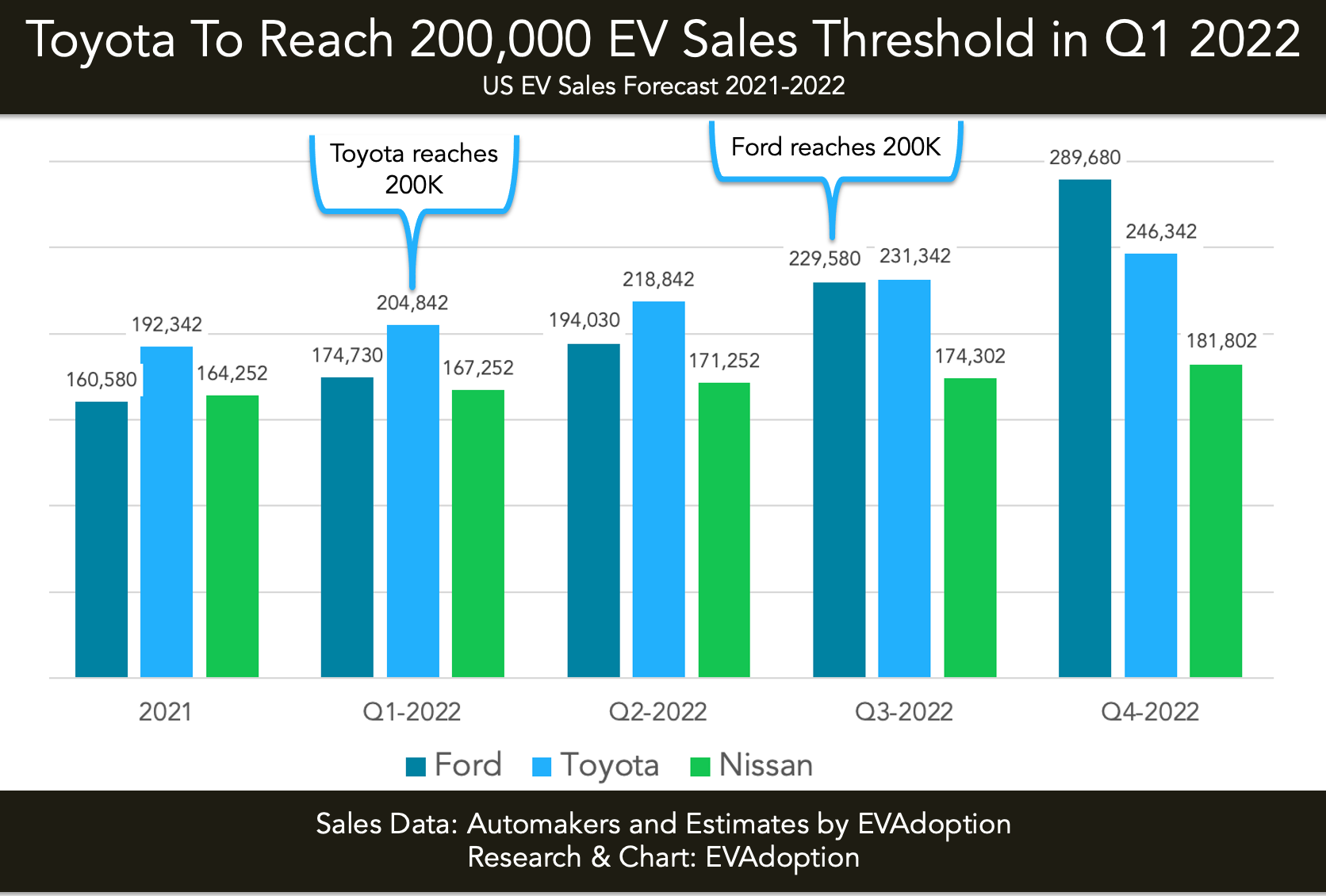

Notice 201367 Qualified 2- or 3-Wheeled Plug-In Electric Vehicle Credit Under Section 30Dg Notice 2016-15 Updating of Address for Qualified Vehicle Submissions. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial installations. The program is structured so that when a car company sells 200000 eligible EVs its tax credit begins to phase out in the second calendar quarter after crossing this threshold.

About Publication 463 Travel Entertainment Gift and Car Expenses. Under the new law the maximum value of the credit rose to 3600 from 2000 per child depending on their age and family income level. The credit amount will vary based on the capacity of the battery used to power the vehicle.

How Much is the Electric Vehicle Tax Credit for a 2021 Tesla.

Legislation Regulations Evadoption

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

How Do Electric Car Tax Credits Work Credit Karma

Latest On Tesla Ev Tax Credit March 2022

Bmw Ev Tax Credit What Bmw Cars Qualify For Ev Federal Tax Credit

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Incentives To Buy An Electric Car Greencars

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Latest On Tesla Ev Tax Credit March 2022

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Roadshow

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Electric Vehicle Tax Credits What You Need To Know Edmunds

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek